The Psychology of Money

Introduction

The premise of this book is that doing well with money has a little to do with how smart you are and a lot to do with how you behave

In Morgan Housel’s insightful book, he delves deep into our intricate relationship with money. As emotional beings, our financial decisions are often steered not by rationality, but by a complex interplay of emotions, biases, and psychological tendencies.

While not a quick read, Housel’s narrative is both engaging and enlightening, offering a fresh perspective on the dynamics of finance.

Within its pages lies an opportunity for introspection, prompting readers to reflect on their own financial behaviors. Moreover, it fosters empathy by highlighting the diverse experiences and backgrounds that shape individuals’ approaches to money management.

In essence, Housel’s work serves not only as a guide to personal finance but also as a mirror through which we can better understand ourselves and others.

Rating: 4.5

1. No one’s crazy

He argues that our understanding of money is often limited by our personal experiences, which represent only a fraction of the broader financial landscape. Despite this, these experiences heavily influence our perceptions and behaviors, shaping our beliefs about how money works.

By exposing ourselves to diverse viewpoints, Housel suggests, we can gain valuable insights into our own financial decisions and motivations.

2. Long term thinking

The book emphasizes the importance of thinking long-term when it comes to investing and personal finance. Housel argues that patience and consistency are key to building wealth over time.

3. Luck & risk

4. The Power of Compounding

The book emphasizes the power of compounding, showing how even small, consistent contributions to savings and investments can grow significantly over time.

5. Simplicity and Humility

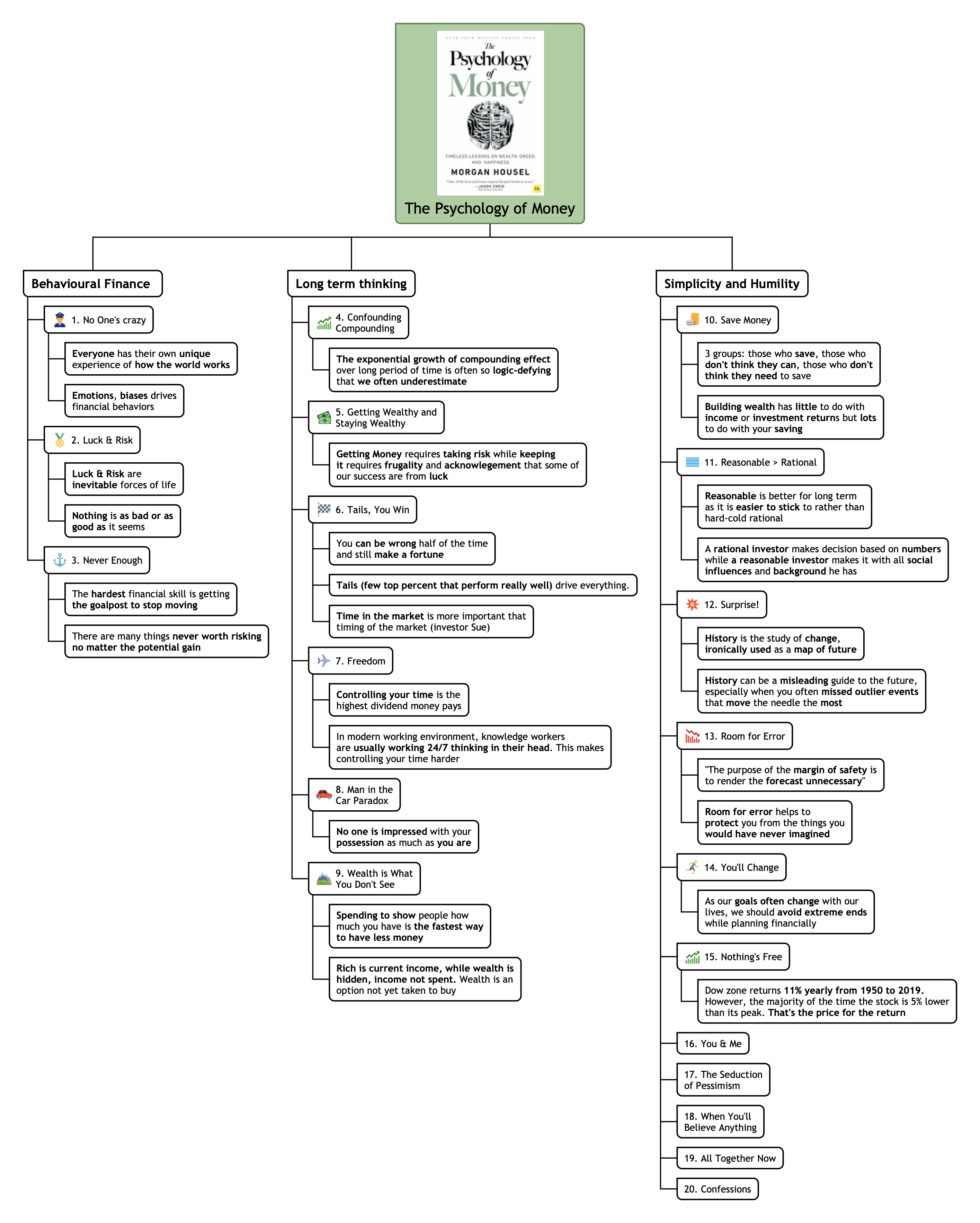

Mindmap